Since 2023, the world has been navigating a balanced phase in a new economic transition model. This global shift influences energy transitions, food systems, and the interconnected realms of geopolitics and military strategy. Beginning in 2000, and more prominently between 2011 and 2022, the economic transition followed a trajectory that culminated during the years 2019-2022. This era was characterized by pandemics, armed conflicts, and reciprocal sanctions that shaped the boundaries of major economic blocs. These boundaries highlight the struggles of developing nations, the expanding sway of Middle Eastern oil producers and China, and the BRICS’ moves toward possible membership expansion. In this context, multinational corporations and transnational organizations are increasingly challenging the Westphalian order, which originated in the 17th century after the Thirty Years’ War and was further solidified globally following World War II. This order, grounded in the principles of state sovereignty and territorial integrity, placed nation-states at the forefront of global politics. However, globalization and the rise of multinational entities have introduced cross-border dynamics that undermine the traditional concept of absolute state sovereignty.

The challenges are deeply influenced by several interconnected factors. Aging populations in developed nations and China contrast sharply with the youthful demographics of Africa and South Asia, creating uneven pressures on global economies. Meanwhile, the slowdown in economic growth, the shift of industrial production to Asia, and the acceleration of technological advancements are fostering new opportunities but also disrupting established economic systems. In addition, the rise of religious and nationalist movements, alongside the idealistic focus of many environmental initiatives, particularly those targeting industrial pollution, underscores the difficulties governments face in adapting to or managing these transitions within an increasingly interconnected world. These dynamics are fueling intensifying tensions among major powers, each striving to either expand or protect their spheres of influence. Against this backdrop, ‘energy transition’ stands as merely one aspect of broader global economic shifts and it is now amply recognized the need to address energy security and sustainability within the larger framework of these sweeping changes in economic transition.

Shift to the Pacific

The global economic pivot from the Atlantic to the Pacific is reshaping energy demand and supply patterns. Current estimates suggest that without further exploration and drilling, global reserves would last approximately 114 years for coal, 53 years for natural gas, and 51 years for oil. Asia, with a population exceeding 5 billion and an impressive 70% growth, is on track to become the epicenter of global energy consumption. This increasing demand isn’t limited to electricity; it spans a broader range of fossil fuel applications. However, local energy production in the region remains insufficient, heavily depending on supply from Australia and Indonesia. Emerging energy zones in Southeast Asia, including Myanmar and Papua New Guinea, are beginning to play a more significant role in addressing this growing need. This geographic and economic realignment underscores Asia’s pivotal role in the future of global energy markets.

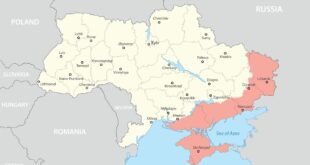

Tensions, alliances and uncertainties in Europe

As the global landscape becomes increasingly unstable, Europe finds itself navigating a delicate balance of geopolitical tensions, shifting alliances, and economic uncertainties. Central to this balancing act are the intertwined issues of energy security and defense, domains critical to the continent’s resilience necessitating profound global transformations. Geopolitical shifts force Europe to re-evaluate its energy dependencies and progressively abandon the “stacked” green dream. Long reliant on imports from politically unpredictable regions, such as Russia and the Middle East, the continent now faces the urgent need to diversify its energy sources. Renewable energy projects, cross-border electricity interconnections, and natural gas pipelines, like those linking Israel, Cyprus, and Greece, for instance the GSI and Eastmed projects, represent key opportunities. However, these projects are fraught with challenges, disputes over territorial rights and sovereignty rather than technical complexities, particularly in the Mediterranean Sea.

Hydrocarbons are shaping the current Mediterranean geopolitical scene

On the trail of these global shifts, the Eastern Mediterranean has gained importance as a strategic crossroads for Europe and the East. This region serves as a vital hub for energy exploration, transit routes, and geopolitical influence, making it a focal point of competing interests. Rich in natural gas reserves and energy potential, the Eastern Mediterranean has attracted investments and ignited territorial disputes among neighboring states. It is not a pleonasm to say that its geographic position places it at the intersection of major trade routes between Europe, Asia, and Africa, further amplifying its strategic value. In today’s energy-driven global landscape, natural gas remains a critical resource, with vast reserves lying beneath the sea. The Southeastern Mediterranean has gained prominence as a focal point for hydrocarbon discovery, production, and distribution. The geopolitical dynamics of the region are shaped by a combination of technical and economic factors, with oil and gas activities serving as pivotal elements. Furthermore, as maritime areas become central to future energy developments, naval operations and defense collaborations have grown in importance to protect critical energy infrastructure. This dynamic underscores the Eastern Mediterranean’s key role in the modern energy economy and its implications for global energy security.

Uncertain oil and gas prices

Simultaneously, protectionist policies like tariffs on essential materials such as steel are increasing production costs for energy infrastructure. A 25% tariff on steel could significantly increase expenditures for constructing pipelines, wind turbines, and solar arrays. Although these tariffs aim to safeguard domestic industries, they hinder Europe’s progress toward achieving energy independence. The urgency to update energy systems while maintaining cost efficiency represents one of Europe’s most critical challenges. This issue is not exclusive to Europe, the U.S. oil industry has also voiced concerns about a potential slowdown, even in the highly productive Permian Basin of Texas and New Mexico. Should oil prices, which stood at approximately $70 per barrel in the U.S. and $73 in Europe as of mid-March 2025, fall any lower, the industry would face significant challenges. Prices have already declined compared to the previous year, while shale wells, characterized by their fast depletion rates, demand regular capital investment to maintain production, with costs estimated at $40 per barrel. Efforts to stabilize oil prices near $50 per barrel as a political target would result in reduced activity, shrinking production, and declining output. This goal has already caused cuts in capital expenditure within the industry for 2025 and 2026. Additionally, service companies predict that a 25% steel tariff will exacerbate production costs.

It is worth comparing this period with the early 1970s to highlight similarities and to avoid repeating past mistakes. Europe’s withdrawal from the Bretton Woods system, which meant the dollar was no longer backed by gold, marked a crucial shift. In this context, the 1973 oil crisis signified the economic transition to dollar dominance, profoundly impacting the energy mix and fueling military conflicts, such as the Yom Kippur War between Arab nations and Israel. The surge in oil prices, from $3 to $12-$15 per barrel as determined by OPEC, financed breakthroughs in exploration methods, field identification, and deep pumping technologies, ultimately leading to the discovery and utilization of subsea oil deposits. A subsequent oil crisis in 1979, driven by the Iranian Revolution, stabilized oil prices at $32 per barrel by 1981. This stability facilitated advancements in efficient oil production techniques, eventually resulting in oversupply. Currently, reciprocal tariffs on goods and the U.S.’s effort to lower hydrocarbon prices to a near-profit threshold risk producing opposite outcomes, destabilizing markets and supply.

Considering the ten years of inaction and prohibition, Europe should perhaps revisit the exploration and exploitation of shale gas, rather than solely relying on imports. Developing shale gas in Europe would contribute to energy independence, a concept that began to take shape in the late 2000s. Could the development of shale gas in Europe foster energy independence?

Shift to Electrification

In Europe, the push toward electrifying transportation, heating, and cooling has coincided with the loss of its once-privileged access to global energy resources, including fossil fuels and critical metals. Broad electrification is anticipated to more than triple electricity demand in Europe, growing from approximately 2,500 TWh in 2022 to 8,500 TWh by 2050. Until sufficient energy storage capacities are developed, one proposed interim measure is the enhancement of cross-border interconnections across Europe. The European network currently has over 100 bottlenecks that need resolution to improve system stability and reliability. Strengthening interconnections would enable efficient electricity distribution across the continent, helping to better balance supply and demand. According to the 2022 edition of ENTSO-E’s Ten-Year Network Development Plan, increasing cross-border interconnection capacity by 64 GW will require annual investments of roughly 2 billion euros through 2030. Looking ahead to the 2030-2040 period, annual investments of approximately 6 billion euros in cross-border capacity, energy storage, and peak units are expected to continue delivering reductions in energy costs year after year.

Epilogue

Europe’s competitiveness has been hampered by high energy costs, strict labor laws, elevated taxes, and regulatory challenges, leaving it at a disadvantage compared to regions like the U.S. and parts of Asia. The EU’s current energy policies remain misaligned with the realities of the global marketplace, raising questions about their effectiveness and adaptability. Without promoting competitiveness, fostering innovation, and encouraging entrepreneurship, sustaining high living standards and achieving environmental goals will remain challenging. As the sands of geopolitics shift rapidly, Europe must prioritize adaptability by leveraging international partnerships and bolstering robust defense strategies to overcome the uncertainty of the times.

Geostrategic Media Political Commentary, Analysis, Security, Defense

Geostrategic Media Political Commentary, Analysis, Security, Defense