Oil-backed trade is helping African nations bypass financial constraints and sustain their economies by exchanging crude for refined fuels and services.

The foundations of trade were built not on profit margins but on survival. Today, as global financial systems become increasingly fragmented and trade barriers are thrown up, we are witnessing a quiet resurgence of neo-mercantilist practices.

As in earlier eras of trade, capital is key—with barter increasingly part of the mix. The first era of globalization (1500s–1800s) was a period when finance was limited to royal treasuries, merchant guilds, and early banks. Global trade went on apace.

For modern nations facing severe economic constraints, currency shortages, or institutional dysfunction, the ability to trade goods without money is once again an option. The future of global trade may very well be written not merely in dollars but also in crude oil and fuel.

Resource Exchanges

Nowhere is this reality more evident than in oil-for-fuel exchanges, particularly in Africa.

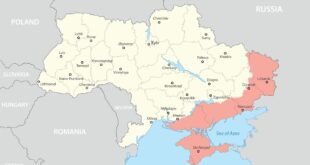

The African Union member states are resource-rich but cash-strapped nations. Many trade crude oil for refined products to keep their economies afloat.

Nigeria’s Direct Sale Direct Purchase (DSDP) program remains a prime example. In recent years, Nigeria has swapped millions worth of barrels of crude oil annually for refined products (gasoline and diesel). This has kept cars moving and generators running in Africa’s largest economy.

Libya stands as another instructive example. Despite possessing Africa’s largest proven oil reserves, the country’s fractured governance and intermittent conflict have undermined its ability to participate fully in global financial markets. In response, Libya has long implemented barter-style agreements to keep its economy running. These arrangements, which had the blessing of the National Oil Corporation (NOC) and the Government of National Unity, allowed crude oil to be exchanged for refined fuel and essential services. United Nations (UN) Envoy Stephanie Williams underscored the urgency of such measures in her September 2020 address to the UN Security Council, noting the dire fuel shortages facing Libyan communities. While these programs were largely successful in addressing immediate needs, some rogue actors exploited them—selling fuel on the black market and complicating broader recovery efforts. Nevertheless, the barter program itself remained a vital component of Libya’s economic survival during periods of intense instability.

A Broader Regional Shift

Libya may draw on the success of Angola, another major oil exporter using oil-backed trade to barter its resources for infrastructure deals with China. Angolan oil has been swapped for transport infrastructure projects and hospitals. Across the border, the Democratic Republic of the Congo is considering a similar deal in which the United States will exchange military assistance for economic resources.

Such barter is not limited to conflict zones or Africa’s struggling states. In response to U.S. dollar shortages, Egypt and Kenya (two of Africa’s most advanced economies) have previously entered into barter discussions built around Kenyan tea. Informal trading networks are centuries old in places like West Africa.

In regions with poor transport networks, inadequate storage facilities, and inefficient distribution systems, the stakes of trade are even higher. Also, in this new era, many African countries are increasing tariffs in line with global trends. No wonder the African Continental Free Trade Area (AfCFTA) continues to languish and feels unfortunately out of step with the current global neo-mercantilist movement.

The Logic of Survival Trade

As global trade becomes increasingly uncertain and financial systems grow more exclusionary, barter is likely to endure—and evolve. It offers a path forward for nations with limited access to traditional markets, serving not only as a substitute for financial transactions but also as a tool of resilience, sovereignty, and survival. This is particularly true in Africa.

We must change our mindset about barter—from the desperate action of the few to a legitimate tool for economic agency. For African nations and others navigating fragmented global markets, commodity-driven exchanges are not a retreat but rather a return to older strategies. Whether divided by financial markets or resource availability, the logic of exchange will endure.

Geostrategic Media Political Commentary, Analysis, Security, Defense

Geostrategic Media Political Commentary, Analysis, Security, Defense