Cyril Widdershoven

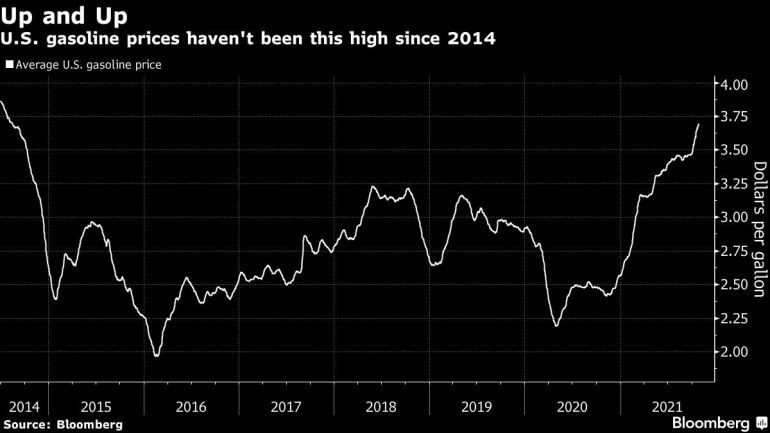

OPEC+ made clear after yesterday’s meeting that it is not going to bend over under pressure of the US Administration and several other consumer countries to open up the taps. With a very strong statement made by OPEC leader Saudi minister of energy Prince Abdulaziz bin Salman the group made clear that it will pursue its current production strategy to confront still fledgling market fundamentals. During its press conference OPEC reiterated that it will be keeping to a rollover of its August program to gradually increase oil production by 400,000 bpd each month. The oil market, according to OPEC officials, is still not back from its pre-COVID stability, while even that oil prices are hitting record levels not seen since 2014, the overall market is still instable. COVID threats, potential Chinese economic recession threats and other geopolitical considerations are not yet giving enough room to increase substantially supply. At the same time, as the Saudi minister made clear, calls made by consumer countries on OPEC+ to increase production are not a sign of realistic assessments. As Prince Abdulaziz stated OPEC+ is not a cartel, but mainly a market stabilizing organization, not looking for higher prices but for a stable and transparent market. The latter, according to Abdulaziz, is under severe pressure, as the current energy crunch experienced in mainstream OECD countries, or especially the US and EU, is not caused by OPEC+ policies, but mainly due to internal domestic policy making effects of the respective consumer countries. While quoting his favorite movie-list, Prince Abdulaziz used the phrase of “the tail wagging the dog”, referring to a 1990s Hollywood movie by Dustin Hoffman and Robert De Niro, to address the fact that US President Biden’s attacks on OPEC+ are not going to force a new oil group strategy. OPEC+ officials are very clear in their assessments, all look at the US-EU energy crunch as a self-made disaster, due to a mismanagement of internal markets and increased pressure on oil and gas production in these countries. By increasing COP26 and G20 related strategy to counter emissions and push for less investments in hydrocarbons, countries, especially the USA, Canada and others, have been the main reason behind the higher prices and lower supply volumes globally. The growing constraints on US upstream, especially shale oil and gas, but also by blocking construction of new hard-needed oil and gas pipeline infrastructure, US customers are now paying the price. The same is in place in the European Union, where environmental policies, mismanagement of gas production (Netherlands Groningen Gas field), Green Deal and Nordstream2, have led to an increased energy import dependency. The lack of realism in European and US green policies, not taking into account that intermittency of renewables and lack of backup by oil and gas (storage) has even led to higher usage of coal fired power generation.

Yesterday’s main message to consumer countries was to reassess the current policy and strategies put in place to cope and counter with future and current stress factors. As Prince Abdulaziz made clear, OPEC+ is not able to manage the market fully, so any referral by other political leaders that it is a cartel is based on fables or total misrepresentation. OPEC also addressed the increased level of challenges put on their plate by an inconsistent and continuously changing political-economic environment, mainly by Western countries. The erratic strategies in place, as shown by leading energy agencies (IEA) or governments (US, EU), have led to an instable investment climate, in which especially privately owned oil and gas companies are not able or willing to invest in hard-needed new production opportunities. As one of the most poignant examples is the lack of production growth currently witnessed in US shale. The former production capacity is not even touched anymore by investors and operators. Even that global oil and gas prices are hitting record levels, asset owners in the USA seem not anymore interested to increase overall production, but only focused on repaying debt and lowering gearing. The latter is even supported by new policies being presented by the Biden Administration, mainly looking at improving the US global standing at international fora, such as G20 or COP26, implying possible blockage of new hydrocarbon projects etc. The latter is at present clearly shooting the Washington Administration is its own foot. By keeping oil and gas production down inside of the USA, not only Washington’s fairy tale of “energy independence” is put on ice, but also consumers, aka voters, are looking at higher gasoline and diesel costs. The latter is not caused by OPEC+ policies, but by the US political leaders themselves. If US oil and gas would be producing up to its own capacity, global prices would for sure be much lower than presently is the case. To blame and shame OPEC+ for this situation is a very weak approach. The Saudi energy minister has tried to refrain from a direct confrontation, but his remarks, which have been vividly quoted by journalists yesterday, are painting a clear message, “Biden get first your act together, before additional actions can be discussed”.

While the whole world is looking at OPEC+ to save the day, analysts are slowly changing their attention to Biden’s future strategies. There is a growing believe in the US that the Biden Administration will decide soon to use the Strategic Petroleum Reserve (SPR) to quell price hikes in the USA. The latter, already presented as a potential threat to OPEC, is however not at all a viable approach. Even if the US Administration will take the unprecedented step to use SPR as a market regulating instrument the overall effects will be minimal or even generate the opposite effect. OPEC’s leaders Saudi Arabia and UAE, combined with its non-OPEC compatriot Russia could easily counter the latter. If Biden would decide to put 30+ million barrels of SPR crude on US markets, a simple reaction could be to cut OPEC+ production by 1 million bpd for a month. No market disturbance would result, while Biden’s strategy is in shambles. Washington’s current power over oil and gas markets is only in the heads of energy policy advisors roaming lobby offices. Without any doubt, OPEC+ is able to counter any SPR move without feeling pain. The current Biden energy statements are really a sign of weakness. With his continuous threats, even backed by hardline anti-OPEC pundits in Washington, who see an option of a new anti-OPEC cartel bill in the air, the Administration is losing its future negation powers already.

Some even could say, an SPR opening would be supporting OPEC+ power position even. As some tried to address during the OPEC press conference, last oil and gas markets analysis shows that OPEC+ has not even been able to increase its production volumes the last month to the agreed upon 400,000 bpd level extra. Only 140,000 bpd have been put extra in the market, mainly due to technical or other constraints in an ever growing list of OPEC+ member countries. Main increases have been made by the usual suspects Saudi Arabia and other Gulf based producers. African volumes however have been lower in general, constraining overall performance. Some could now argue that some OPEC advisors are hoping for additional production in the US, and maybe even Canada, so that a risky new strong call upon OPEC+ crudes is not necessary. Another 1-2 months of lower than expected production levels being reported by OPEC+ could push analysts to doubt the always quoted excess production capacity in place. The latter, mainly thought to be in the hands of Saudi Arabia, UAE and maybe Kuwait or Russia, could however become doubtful, if a real need occurs due to a mishap or geopolitical crisis.

The next couple of months, OPEC+ could be sailing with a strong wind in its back. As Russian Energy Minister Alexander Novak reiterated during the OPEC+ press conference “the decision was made previously to increase production by 400,000 (barrels per day) every month, and I underscore every month, until the end of 2022”. If the latter is seen as a full OPEC+ statement, no real oil production spike is going to see the light very soon. Novak’s remarks about a very fragile demand globally in place, have been supported by Saudi’s Prince Abdulaziz too. Still, the call will be increasing, even if COVID will be a destabilization factor still during the winter.

At the same time, economics are very clear. OPEC+ is not willing to push prices down because of several reasons. The still fragile demand picture is a major supporting factor, but is also being used to have prices stay at a reasonably high price. As the Saudi energy minister reiterated repeatedly, without high price levels the future of oil and gas is very shaky. With a low oil price, investments in existing and future production are crippled. UAE energy minister Suhail Al Mazrouei reiterated that OPEC+ and all consumer nations need to work together to smooth global economic recovery from COVID. Al Mazrouei also said that the current 400,000 bpd increase will ensure a smooth sailing, as a rebalancing of market fundamentals is being supported.

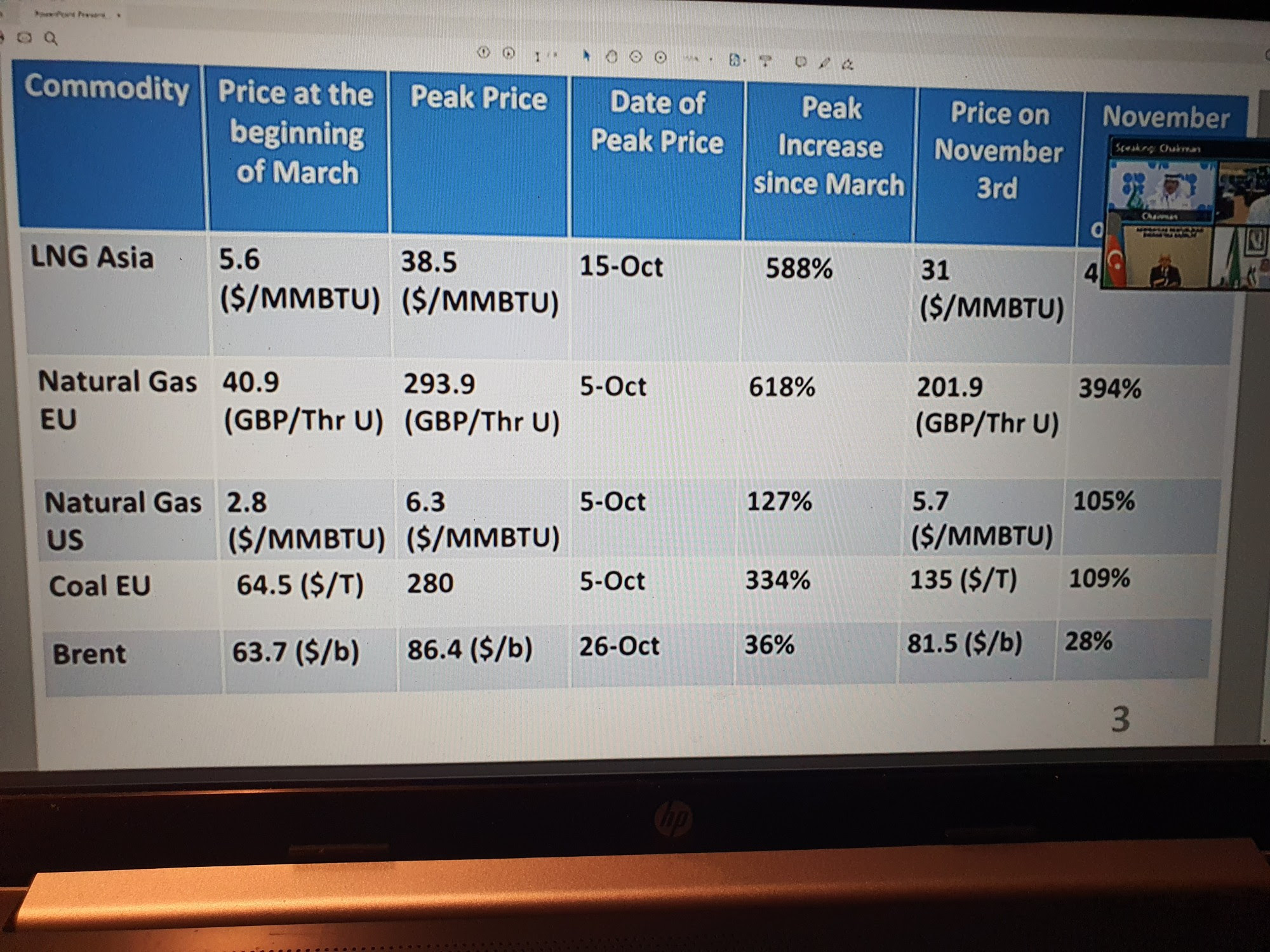

All OPEC members, but especially Prince Abdulaziz bin Salman, also have pointed to the unrealistic picture being painted by the USA, UK, EU and even Asian countries. The current energy crisis is painted as an oil crisis, while reality is different. Natural gas and coal price levels have increased exponentially more than the global crude oil benchmark Brent. Abdulaziz even showed a graph to the media, on which the price increased of natural gas (EU +394%), LNG (Asia 400+%) and coal (EU +109%) showed a very bleak price increase, while Brent only increased during the same period by 28%. In a main attack of US-EU statements, the Saudi minister said that it is clear that regulation and management of natural gas, coal and LNG markets needs to improve, taking advice from the OPEC+ supply regulating position. Al Mazrouei said that if “you look at the gas market, you look at the coal, the lack of having a governor of the market makes it so difficult for the consuming nations when it comes to a huge increase in the commodity prices”. As the Abu Dhabi energy minister indicated also “we haven’t seen that happening to oil in the same magnitude because of this group.” His Saudi counterpart made it clear by stating ‘oil is not the problem…What is the problem is the energy complex is going through havoc and hell.”

The OPEC+ press conference will have put oil on the fire already burning in the minds of Washington backers. In a first reaction, the White House accused again OPEC of imperiling the global economic recovery by refusing to speed up oil production increases. Biden clearly is looking for a way to get his message not only to OPEC+ but also back home to his own constituency. The US president is looking to be back on the international stage, especially after that he led the charge at the UN climate change conference for the world to cut back on fossil fuels. Still, OPEC leaders don’t seem to be impressed by an Administration that is out of tough with reality, and is threatening ‘to use all tools” to bring down fuel prices. In a reaction to the Financial Times (FT) Jennifer Granholm, the US energy secretary, already indicated last month that a release of oil from the country’s strategic stockpiles was among “tools” the Biden administration. At present this is not a sharp Yakuza sword, but looks more like a blunt kitchen knife. The other utensils available in the kitchen of Biden are still unknown, but maybe they could be better be used to cut a Turkey for Thanksgiving or Christmas than to be used in a geopolitical power contest with Saudi Arabia, Russia and the UAE. Until the next OPEC meeting on December 2, we will be hearing a lot of political threats and knives being sharpened. Blood at present is not on the wall, except maybe from the foot of Biden as it seems he has been shooting his own foot.

***A possible rabbit out of the Biden’s Hat could however be a dramatical U-turn on Iran. A possible much more ‘forgiving’ approach towards the ultra-conservative Raisi regime offering a full JCPOA agreement could push the market to instability, as Iranian oil would become available. Still, the latter will not save the current winter or 2022 even, as most will be hitting markets later.

Geostrategic Media Political Commentary, Analysis, Security, Defense

Geostrategic Media Political Commentary, Analysis, Security, Defense