Mexico’s president-elect will enjoy a wide electoral mandate, yet her predecessor wants to leave office with a flurry of questionable constitutional reforms.

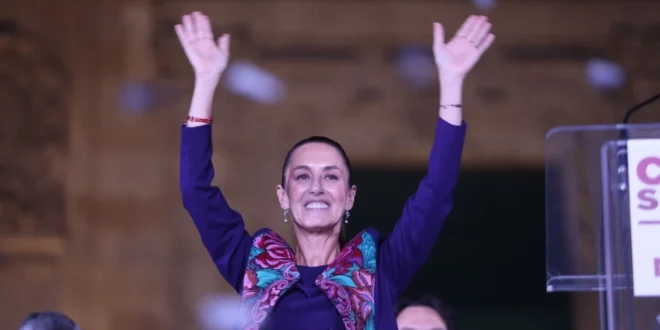

Mexico voted overwhelmingly for Claudia Sheinbaum to become its next president. She won nearly 60 percent of the popular vote—6 percent more than the incumbent President Andres Manuel Lopez Obrador (AMLO) obtained in 2018. The political coalition led by the Morena Party secured commanding majorities in both houses of Congress and obtained victories in state electionsacross Mexico.

With this impressive victory, however, come challenges that will send clear signals about how this new super-majority intends to govern Mexico and what kind of partner the United States can expect to deal with.

AMLO, with Morena’s congressional majorities, seeks to transform the coalition’s victory into approval of significant constitutional reforms in September before Sheinbaum is sworn in on October 1. While it is not yet clear how many of AMLO’s proposed reforms will be presented in September, he has clarified that he wants to initiate massive judicial reforms, alarming a wide range of Mexican and U.S. experts and businesses.

The reforms championed by AMLO will also create a fait accompli for incoming President Sheinbaum, who is simultaneously assembling her cabinet and planning the first steps of her six-year term.

If all were approved, AMLO’s eighteen proposed reforms would centralize more power in Mexico’s president, reduce the checks and balances on the executive branch, diminish the court system, eliminate various autonomous agencies, enshrine various AMLO-sponsored social programs into the constitution, raise concerns about compliance with the U.S.-Mexico-Canada trade agreement (USMCA), and much more.

AMLO sees these reforms as essential. His so-called “Fourth Transformation,” seeks to continue vital changes in Mexico and establish a more egalitarian country. Others see them as posing serious threats to the advances made in Mexico’s democracy and economic and political governance over the past decades.

The scope of change in Mexico’s institutions would be stunning. For example, the proposed judicial reform would lead to the replacement and the election of an estimated 1,600 federal judges across the country, including in the Supreme Court. Many see this reform as politicizing the judicial system and threatening the rule of law and legal certainty. One study of the judicial reforms by United States and Mexican legal experts argues the proposals “would eliminate the separation of powers and the system of checks and balances crucial for the survival of constitutional democracy.”

If approved as proposed, several of the reforms would have a major impact on relations between Mexico and the United States. For example, one reform would eliminate economic and regulatory best practices and commitments built into the USMCA trade agreement. Under USMCA, Mexico became the U.S.’ top trade partner, and Mexico has become more attractive as a potential site for nearshoring to strengthen North America’s economic competitiveness. Nervous markets are already reflecting concerns about the impact of the proposed judicial reforms on Mexico’s legal operating environment for foreign and Mexican businesses.

AMLO, Sheinbaum, and their supporters argue that these changes will support more economic growth and reduce economic inequality, as they promised the voters. They do not see the reforms as undermining trade, investment, or democracy and pledge to sustain good U.S.-Mexico cooperation, including within USMCA.

However, the next few months might be rocky as AMLO and his allies push for rapid approval of reforms despite warnings and objections from political rivals, concerned civil society groups, and private Mexican, U.S., and other international businesses.

Whatever evolves over the next few months, the U.S.-Mexico agenda will remain vital for both countries. Managing migration, public security, drug trafficking, trade, and investment will be top priorities for both governments. The upcoming U.S. elections will bring more debate over Mexico’s role in migration and in allowing deadly opioids like fentanyl to flow into U.S. cities. Both nations will also need to grapple with some contentious trade issues. Mexico’s growing trade surplus, existing U.S.-Mexico USMCA trade disputes, and rising concerns aboutChina’s influence will be critical topics of discussion.

Sheinbaum’s more disciplined leadership style and approach to policy will be fundamental in determining the U.S.-Mexico partnership during her six-year term. Her 100-point government plan signals encouraging changes, notably in energy and security, but it will continue AMLO’s priorities and statist approach in many ways. Given Sheinbaum’s scientific and engineering background, many believe there could be substantial changes in the energy sector while maintaining the state’s domineering role.

Sheinbaum proposed to attract foreign direct investment in clean and renewable energy while simultaneously maintaining 54 percent of power generation in the national electricity company CFE. Sheinbaum is expected to be more pragmatic about energy efficiency. She will, however, face serious budget and fiscal constraints, rising energy demand, and a USMCA trade dispute initiated by the United States and Canada.

On security, Mexico’s first female leader proposed creating a National Intelligence System to enhance investigation and law enforcement efforts as well as to improve coordination among key agencies. This is very positive, but much work will be needed to make significant improvements in dealing with thepowerful criminal groups, regular violence, and high levels of impunity, which led to the most negative ratings for AMLO and much election violence.

Progress will demand an effective national strategy encompassing sub-federal authorities, increased investment in institutions, and capacity building. As Mexico City mayor, Sheinbaum cooperated with U.S. agencies and appeared open to continuing such collaboration. However, Sheinbaum will continue to rely heavily on the National Guard and Mexico’s military, continuing with AMLO’smilitarization of public security. Success will be hard to achieve and demand more U.S.-Mexico trust and collaboration.

On migration, the Sheinbaum administration is likely to maintain Lopez-Obrador’s policies on managing migration flows in cooperation with the United States. Sheinbaum, like AMLO, believes that poverty is the key driver of migration and plans to ask for more U.S. economic assistance to Central America and others. Mexico is the United States’ top trading partner, with two-way tradein 2023 totaling almost $800 billion. Both economies are deeply intertwined, interconnected, and interdependent. Mexico’s trade and investment support some 5 million American jobs. U.S. trade accounts for some 80 percent ofMexico’s exports. Furthermore, remittances from the United States contributed to $63 billion in 2023.

Since the USMCA replaced NAFTA in 2020, North American trade has grown over thirty percent. The three countries will review the USMCA’s performance in 2026. The overarching challenge for North America’s leaders is to establish the conditions, rules, workforce, energy resources, and security to strengthen North America’s global competitiveness while promoting job creation and prosperity.

While the governing Morena party won by massive margins, Sheinbaum faces challenges from within her coalition’s ranks and possibly from AMLO himself. The former president created Morena, and many party leaders are still loyal to him. If AMLO pushes Congress to approve some or all of his constitutional reforms, the political climate could become far more complicated. Sheinbaum has stated that the proposed constitutional reforms should be debated and analyzed before receiving approval, a sign that she seeks to avoid confrontation and create certainty for investors and global markets. However, it is unclear how events will unfold or if reform proposals will be tempered. AMLO and other Morena leaders have clearly stated that they intend to press hard to win approval for the judicial reforms and possibly others. Serious questions are being raised and debated about the potential effects.

Mexico’s new president has a powerful mandate. Still, she faces many challenges, including weakened government capacity, serious fiscal limits, high popular expectations, and her mentor and predecessor trying to secure his legacy of “transformation.” The next several months will set the tone for the Sheinbaum presidency and indicate the quality of partnership that the United States and Mexico will be able to build going forward.

Geostrategic Media Political Commentary, Analysis, Security, Defense

Geostrategic Media Political Commentary, Analysis, Security, Defense