Rahul Ajnoti

The recent decision of the new head of Twitter, Elon Musk, to sack approximately 50 percent of the workforce is only indicative of the recession that is glooming over the world. The story of Twitter is just one example among many visible ones. Almost all the major firms around the globe have or are planning to lay off employees, including Microsoft, Meta, Tencent, Xiaomi, Unacademy, etc.

According to a comprehensive study titled ‘Risk of Global Recession in 2023 Rises Amid Simultaneous Rate Hikes’ by the World Bank, all the nation-states are tilting towards a cascade of economic crises in global financial markets and emerging economies, leading to long-term damages. The report blames central banks around the globe for raising interest rates to tackle inflation caused due to the Coronavirus pandemic and Russia’s aggression on Ukraine in the European arena. The report states that even raising the interest rates to an unprecedented high not seen over the past five decades will be insufficient to pull global inflation down to the pre-pandemic levels. It further instils the need to focus on supply disruptions and subside labour-market pressures. The President of the World Bank Group, David Malpass urged policymakers to focus on boosting production instead of cutting consumption and make policies that generate auxiliary investments, improving productivity and capital allocation, which are crucial for growth.

Economics 101: Recession

Amidst the pandemic, many states released relief and stimulus packages that heavily leaned on measures to expand liquidity, such as loosening lending restrictions or reducing repo rates (the rate at which commercial banks borrow money from the central bank) as well as reverse repo rates (the rate at which commercial banks lend money to the central bank). China was the first state to act upon these stimulus measures to counteract the disruptions caused by the covid, followed by Japan, the EU, Germany, India and so on. Though the measures helped economies absorb the pandemic’s impact, one major drawback was increased demand due to induced money flow in the market, leading to inflation.

Inflation, defined as the rate of increase in prices of general goods and commodities in a given period of time, can be caused by multiple factors. A shortfall in aggregate supply, one of the most common factors, can lead to excessive demand pressures in the market. To curb inflation, central banks often tweak or change the fiscal and monetary policies of the nation. Increasing the interest rates is one such measure, as it tightens the economy’s banking system and thus contracts the flow of money, reducing already high demands. However, suppose only the rates are increased without substantial reforms in line with resetting the supply chains, increasing production and overall growth to meet the demand; in that case, a country may move towards a recessionary period. Therefore, alongside rising rates, a nation must diversify its suppliers, invest in technology (without increasing the debt burden), and focus on self-reliance while sustaining employment.

The International Monetary Fund (IMF) defines recession practically as the fall in a country’s Gross Domestic Product (GDP), i.e. a decline in the value of all the produced goods and services in a country for two consecutive quarters. Simply, a recession is a period of massive economic slowdown. Pointing at a specific moment when a recession occurs is almost impossible and futile. However, a few indicators, like the downfall of GDP and public spending, increased unemployment, and a decline in sales and a country’s output, generally point towards an upcoming recession. To sum up, there are various ways for a recession to start, from sudden shocks to the economy and excessive debt to uncontrolled inflation (or deflation) and non-performing asset bubbles.

The Stumbling Economies

According to IMF Managing Director Kristalina Georgieva, “First, Covid, then Russia’s invasion of Ukraine and climate disasters on all continents have inflicted immeasurable harm on people’s lives.” One-third of the world economies, including the United States, Europe and China, are expected to contract in the subsequent quarters.

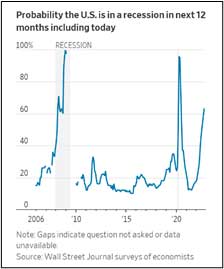

For US economists and forecasters, the recession is no longer about ‘if’ but ‘when’. The decision of the Fed (US Central Bank) to increase rates to cool inflation without inducing higher unemployment and an economic downturn has only shrunk the possibility of a ‘soft landing,’ which occurs when the tightened monetary policies of the Fed reduce inflation without causing a recession. Nouriel Roubini, one of the few economists who rightly predicted the financial crisis of 2008, also claims a prolonged and inevitable recession in 2022 that will last till 2023. Economists expect a growth rate of 0.4 percent in the fourth quarter of 2023 as opposed to the fourth quarter of the previous year, and in 2024, they expect the economy to grow at 1.8 percent. The rate of unemployment is expected to rise to 3.7 percent in December this year and to 4.3 percent in June 2023, compared to 3.5 percent in September.

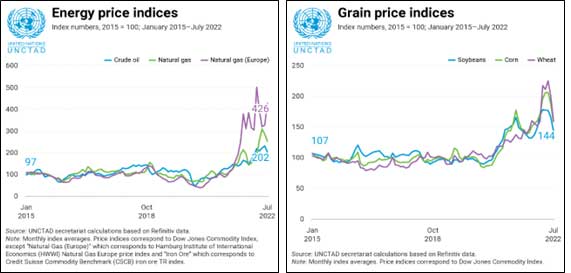

Like the US, Europe was also under the impression that the economic situation would improve without a recession. Assumptions of subsiding or transitory inflation due to solid businesses, enough public savings and adequate fiscal adjustments turned out wrong for the European economies. The Euro area (5.1 percent), and the UK (6.8 percent), are among the countries with the most expected output loss. Europe has mainly been affected by the Russian war on Ukraine and the resulting oil and gas disruptions leading to an ‘Energy War’ against the former. Similarly, China doesn’t lie far from them, with an expected output loss of 5.7 percent in 2023. Zero Covid Policy, coupled with the mortgage crisis and exodus in the manufacturing sector, has led to the economic slowdown of the Asian giant.

Impact on the Indian Economy

India reported a growth of 13.5 percent in the April to June quarter and became the world’s fifth-biggest economy, taking the spot of Great Britain. However, this growth results from the nation’s shutdown amid Delta-driven covid lockdowns during previous quarters and not because of the significant improvements in the economic activities. India needs to focus on skill-based human development projects to unleash its economic potential and effectively utilise its demographic dividend. However, India is not immune to the global slowdown. It is expected to face an output loss of 7.8 percent in 2023.

Indian CEOs are also expecting a decline in the growth of companies, but the economy is expected to bounce back in the short term, according to KPMG 2022 report. Moreover, 86 percent of CEOs in India expect an impact of up to 10 percent on earnings in the next 12 months. Reducing profit margins, boosting productivity, diversifying supply chains, and implementing a hiring freeze (worst case, layoff policies) are a few steps firms can take to weather such challenges.

India, thus, needs to tap the potential of start-ups and small enterprises, as opposed to just established firms, by expanding and enhancing the private sector’s access to capital investments and curbing environment-related risks. Reforms in dispute resolution mechanisms are also long overdue, evident through the Ease of Doing Business report, where India ranked 63rd out of 190 countries worldwide. India needs to prove its worth by showing investors that not only can their money achieve decent returns, but it is safe in Indian soil as well.

The stand on India’s future remains split. The global rating agency S&P claims that India will not face the true and horrifying brunt of the global recession thanks to its decoupled economy with huge domestic demand, healthy balance sheets and enough foreign exchange reserves. On the contrary, according to the Japanese brokerage firm- Nomura, policymakers are misplaced in their optimism about India’s growth trajectory. Its economists assert India’s estimated growth at 7 percent in FY23, which is at par with the RBI’s revised forecasts, but it also predicts a sharp decline to 5.2 percent in FY24. This estimated growth doesn’t align with India’s commitment to becoming a 5 Trillion USD economy.

Way Forward

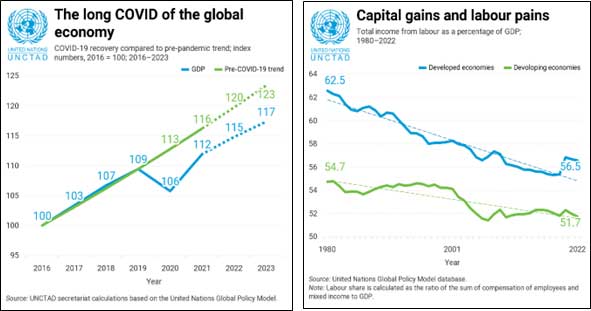

UNCLAD’s Trade and Development Report 2022 projects global economic growth will plunge down to 2.5 percent in 2022, followed by a drop to 2.2 percent in 2023, costing the world a loss of more than 17 trillion USD in productivity. It further warns that the developing nations will be most vulnerable to the slowdown resulting in a cascade of health, debt and climate crises. Regarding the proportion of revenue to public debt, Somalia, Sri Lanka, Angola, Gabon, and Laos are the worst-hit countries, evident through the excessive inflation these states face.

Similarly, Indian fuel and food commodities prices have increased, but India’s sturdy performance when other countries are struggling can be attributed to its efficient policies. India does not have a perpetual external debt burden to hamper its growth. In addition, the government has focussed on developing the industrial and service sector to promote jobs and increase savings, especially after the Pandemic, to revitalise the Indian economy. Domestically, the government has provided effective social safety nets to ensure healthy livelihood for the population.

Despite these factors, India must realize and accept the harsh reality of the upcoming turbulent times. India may have a decoupled economy, but the world is one interlinked system. Global slowdowns will lead to a recession in India as well, whose effects are becoming more and more visible with each passing day. Major tech firms in India like Wipro, Tech Mahindra and Infosys have revoked their offer letters to young freshers, while others have started laying off employees amidst the fear of global recession. Irrespective of whether India becomes the “fastest growing economy” in the end, even a modest growth rate of about 5 percent will push millions into poverty in a country like India. It’s only imperative to realise that a depreciating currency and elevated inflation will hit the poorest the hardest, and India must be prepared to deal with this challenge.

Geostrategic Media Political Commentary, Analysis, Security, Defense

Geostrategic Media Political Commentary, Analysis, Security, Defense

You must be logged in to post a comment.